About Me

Hi, I'm Daniel. Some call me Sangyoon. I was born in the U.S., but

spent most of my life in South Korea 🇰🇷 and Singapore 🇸🇬, before

returning stateside for college and work.

My career spans Wall Street, early-stage venture investing, and

two startups as a software engineer.

As a venture capitalist, I've found and backed billion-dollar

businesses at the earliest stages. As a bootstrapped founder, I've

achieved a 7-figure outcome, and raised venture funding for

another.

On my

Substack

✍🏼, I write about two of my career interests - fundamental

investing and decentralized technologies ₿. In the former, I

discuss everything from undervalued small-caps to unique insights

on value investing. In the latter, I write about fundamentally

valuing crypto-assets, and other rare perspectives on the

industry. Occasionally interspersed are tidbits of my personal

life.

When I'm not going down rabbit-holes and writing, you can find me

playing tennis 🎾, golf or poker with friends. When I'm alone, I

love playing Chopin or movie soundtracks on the piano 🎹, though I

need to start learning some new pieces again. I enjoy trying new

types of coffee ☕ (I was once a Starbucks barista in my teens),

and aim to be half-vegetarian, since I'm not brave enough to go

full-on just yet.

That's a little bit about me. But if you'd like to learn more

about how I got here in the first place, come join me below.

Ever since taking a summer camp course in middle school called

"Who is Dow Jones?", I fell in love with the art of investing. I

particularly enjoy that it rewards independent, even contrarian,

thinking and an even temperament. I chose to attend NYU Stern for

their well-renowned undergraduate finance program, but deferred by

a year to take a value investing course and pore through books

like "The Intelligent Investor" at the local library.

During college, I took advantage of being in NYC to intern at

three different hedge funds, grateful that such institutions would

even take a student like me who knew nothing. After graduating, I

started as an investment banking analyst. In some ways, I was

living the life - early 20s in the heart of New York, exploring

hobbies together with my two housemates - hip hop dancing (where

I'm sure the instructor gave up on us), boxing, or hosting friends

at our den that had become a makeshift poker room.

We also found ourselves chained to our desks on many weekends.

While banking was touted to be a good stepping stone to greater

things, I didn't see how it was making me a better investor,

particularly a long-term investor hoping to build real businesses.

It was in the midst of this environment, wondering what more there

was to life, that I discovered cryptocurrencies.

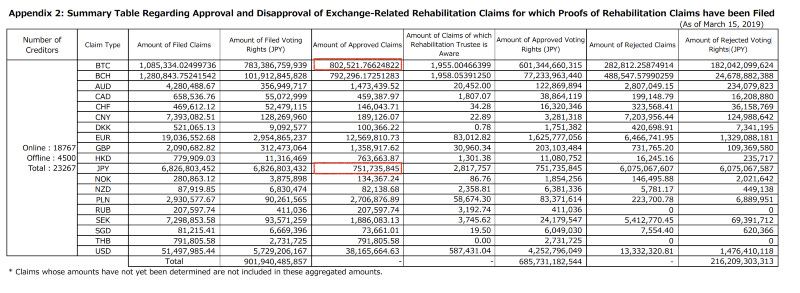

Long story short, I started arbitraging inefficient crypto

markets. This was 2017 when the market was rife with

inefficiencies.

At the time, crypto was booming. Booming so much that there

was a 30-50% spread between Korean and American crypto prices.

The opportunity was so blatant that everybody was talking

about it, yet nobody thought to actually trade it. Why? I

don't know. I asked a lot of people, and they didn't think it

was possible because of this regulation or that blocker.

With a little investigation, I sorted out the legal and trade

mechanics and was making $15,000 every single day, with just a

few clicks. This was possible because I identified the

opportunities, stayed abreast of developments, moved fast,

managed risk, and pulled all-nighters to do the grunt work

from talking to lawyers to setting up trades — all while

working a 70-80 hour / week job…

After this interesting incident, a few friends and I decided

to arbitrage the price differentials among exchanges... The

trading was run from our tiny NYC bedroom, with rotating

sleeping schedules to keep an eye on the markets 24/7. At one

point, our portfolios were worth a couple million dollars. It

was unbelievable for 23-year-olds whose bank accounts had

never seen anything remotely like it. Needless to say, it was

an exciting time. -

Medium: How I Made $15,000 / Day as a Fresh College Grad

This and other early investments made me a millionaire by my mid

20s. I felt empowered - that I too could pave a path in this world

following my own beliefs, and that it was ok to be different.

This and other early investments made me a millionaire by my mid

20s. I felt empowered - that I too could pave a path in this world

following my own beliefs, and that it was ok to be different.

But I quickly felt empty.

The best in the space were engaged in a movement, not just

profiting off market inefficiencies. I packed up, said goodbye to

friends in New York City, my home of five years, and left my old

life behind.

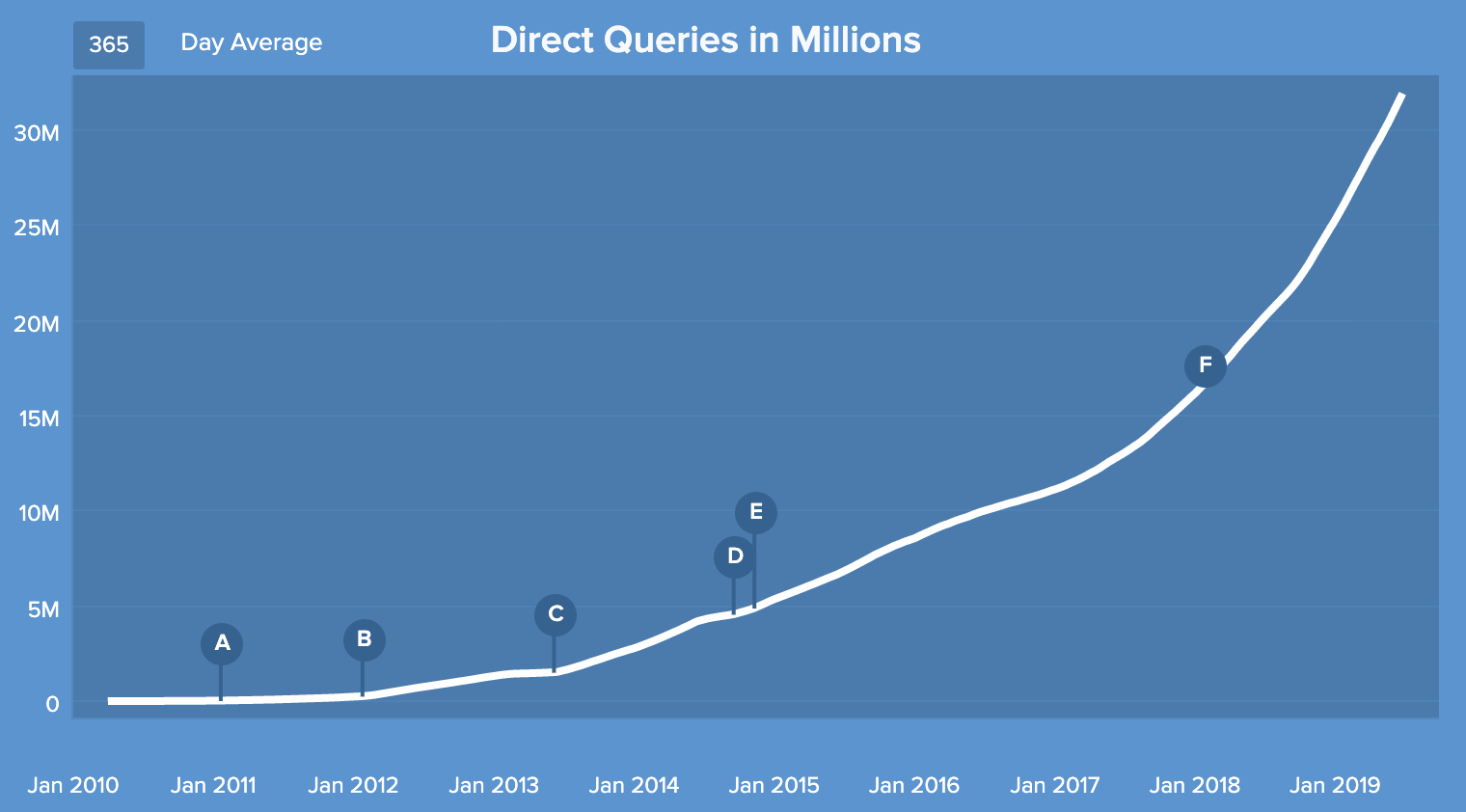

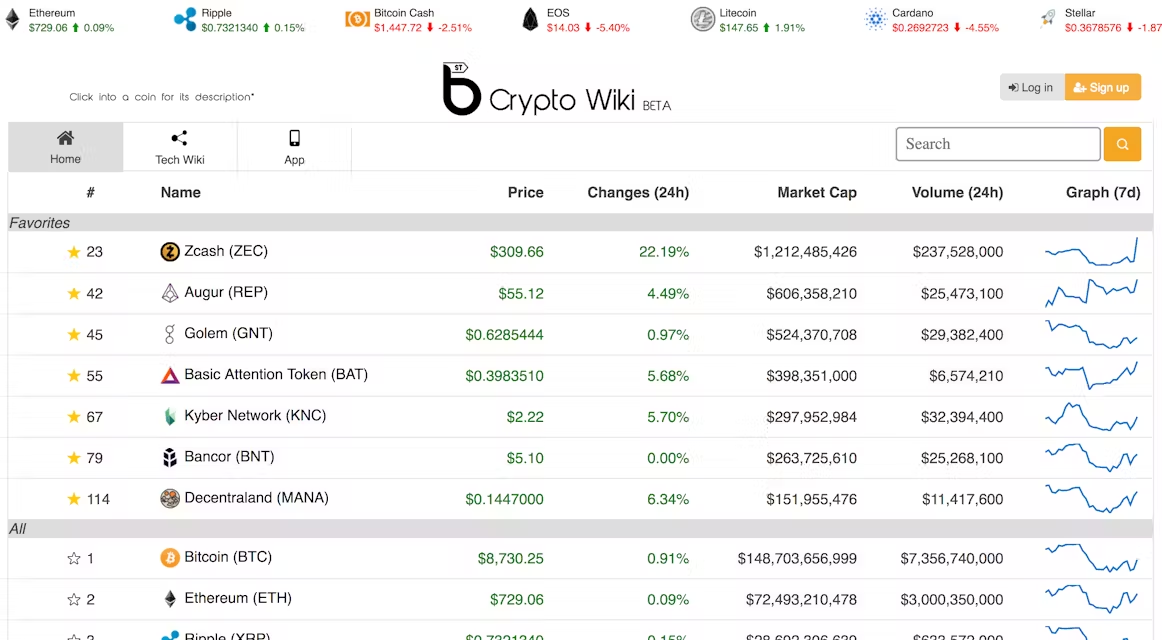

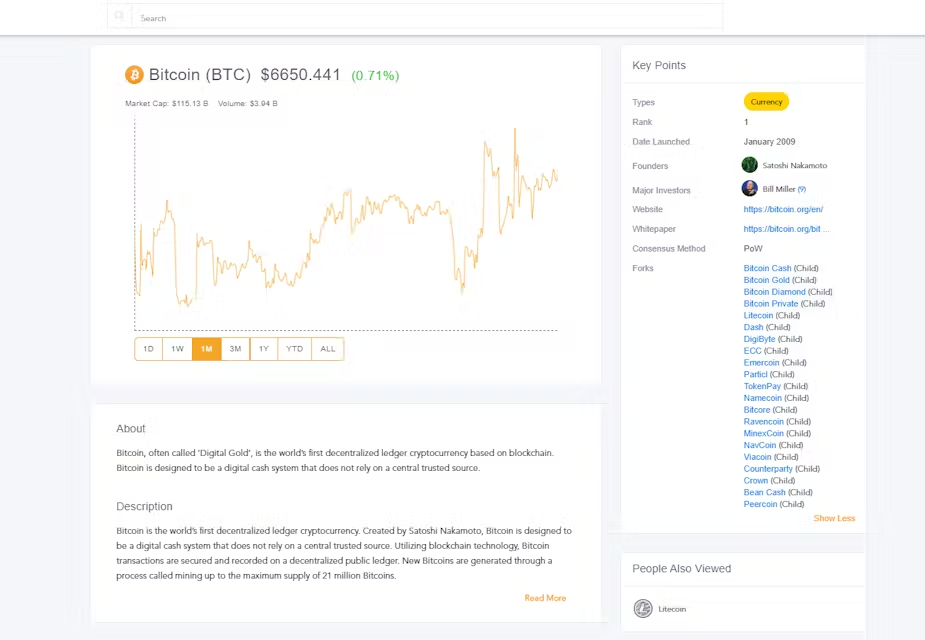

I would move to the Bay Area in 2018, at age 24, to write a book

and make a Wikipedia for crypto. Hundreds of projects with

technical jargon were popping up every day, where even someone

full-time like myself would get lost in it all. I wanted to help

people cut through the noise and understand why this technology

mattered.

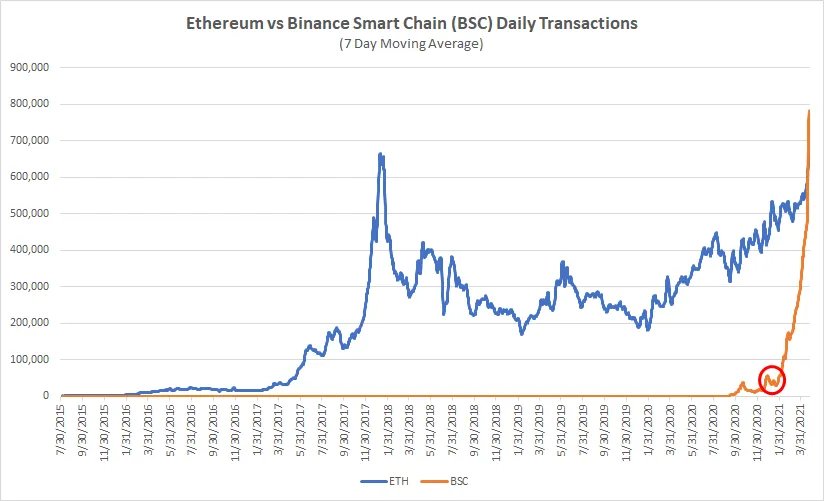

To me, crypto is an equalizing force - an open industry where

people are judged on merit, creativity and contribution rather

than status, and a technology that enables people to more

equitably share in the wealth that innovation creates. Imagine

every time you rode an Uber, you earned equity in the company.

That's a small example of what crypto rails make possible. On

Ethereum, you can access loans from a decentralized protocol with

just an internet connection, not gated by income, ethnicity, or

social status. With DePIN systems like Helium, I am both a

consumer and owner in the mobile network I use.

To me, crypto is an equalizing force - an open industry where

people are judged on merit, creativity and contribution rather

than status, and a technology that enables people to more

equitably share in the wealth that innovation creates. Imagine

every time you rode an Uber, you earned equity in the company.

That's a small example of what crypto rails make possible. On

Ethereum, you can access loans from a decentralized protocol with

just an internet connection, not gated by income, ethnicity, or

social status. With DePIN systems like Helium, I am both a

consumer and owner in the mobile network I use.

While building the wiki, it dawned on me that helping more

projects in the ecosystem would help scale my impact faster. By

good fortune, mutual connections put me in touch with venture

capitalist Tim Draper and I joined him in investing in early-stage

projects. I had respected him for being one of the first prominent

figures to lend credibility to the space as far back as 2014, and

wanted to learn everything I could from him.

I invested early in projects like Arkham, which increased the

transparency of murky on-chain transactions, and the investment

would grow 100x within a couple years of investing. Or Polymarket,

which I saw go from an experimental project to transacting

hundreds of millions of dollars in predictions every day from

people around the world. I supported them because they were both

founded by college dropouts that reminded me of my wiki-building

days. We all strived to build tools that educated and gave greater

opportunity to anyone with an internet connection.

Others, like MakerDAO, would enable more people to access loans or

lending opportunities through its decentralized protocol. And of

course, there were more established companies like Coinbase and

Ledger, whom I had the privilege to support and watch as they

become indispensable companies for the ecosystem, the former which

would IPO at a $100 billion valuation.

Interestingly over time, I felt simultaneously more involved and

more on the sidelines. I missed being a player on the field.

Near the end of my time there, Tim asked me if I wanted to raise a

crypto-only fund together that I could manage. By then, the

industry had become mainstream and big-name funds were reaching

out, offering high six figure salaries to run crypto investments

for them as a partner. It felt full-circle from the days when

people viewed me as an outsider, and when I myself had no idea if

any of this would work out.

But it felt too early to settle down. I wanted to be in the arena

again.

To wrap up my years of self-taught programming, I

did a coding bootcamp

(a very intense three months of 14-hour days, 6-7 days a week of

coding), after which some old friends convinced me to co-found a

startup with them. One had sold his last startup to Bitgo, and was

itching to do something new. I'd happily raise the funding, but on

one condition - that I would work as a full-time software

engineer.

Their condition, in turn, was that I raise the first round of

financing only from angels and smaller funds (to reserve an

institutional round for later) while only diluting ~10% of our

equity. That was quite a bar, as most of my connections were at

institutional funds, and I'd have to collect many small checks at

a very high valuation. With some luck, I was able to round up

about $3.7M in a month right before the market crashed in 2022,

from entrepreneurs I respected like the founders of Youtube,

Twitch, Rotten Tomatoes, Kabam, Y-Combinator OrangeDAO and others.

We initially built a marketplace connecting crypto gaming guilds

and players that quickly amassed tens of thousands of players and

the top guilds like YGG and Ancient8. Crypto gaming created a new

opportunity for people, especially in third world countries, to

earn a living, capitalizing on crypto's ability to "earn" equity

in a project as a gamer. But when the market turned drastically,

the economics of this experiment failed, and the guilds, some of

which had raised tens to hundreds of millions of dollars, went out

of business, along with the players.

We struggled for months, debating a new direction. Then I thought

back to my experience losing bitcoin to institutions that crashed

in 2022. It was a lesson in how the first cryptocurrency, Bitcoin,

was intended to be stored: self-custodied, seizure-proof and

censorship-resistant. I also saw that the Safe multisig protocol,

an open-source smart contract for self-securing crypto assets, was

growing rapidly. That was how our

multi-signature crypto wallet

was born.

We built a prototype and won 1st place from over 100 projects in a

one-month hackathon hosted by Safe, Coinbase and Stripe. Some

companies were interested in acquiring the technology and having

us build in-house.

We reached a point where we had to decide on serving just retail

or enterprise users, and ultimately, my co-founders chose the

former. I was proud of all we had built, but that was not the

direction I saw myself building for the next many years. After

ruminating, I asked to take a step back and support them as an

advisor. This would free up equity to hire others more passionate

about retail wallets, and I could explore my next aspirations.

Lately, the team has been growing users fast, and I'm excited to

see where they take it. See my

Code

section for more on Nest.

I've learned so much from founding a company. Going through the

ups and downs has made me a much more empathetic partner to

founders I advise or work with today. I know what it's like to

grind day in and out managing codebase, partnerships, investors,

user interviews and finding product market fit. I would do it all

over again.

The curtains are closing on my 20s, and I'm looking forward to

what my 30s will bring. I hope to have more adventurous stories

for you then. Until next time.

- Daniel Sangyoon Kim

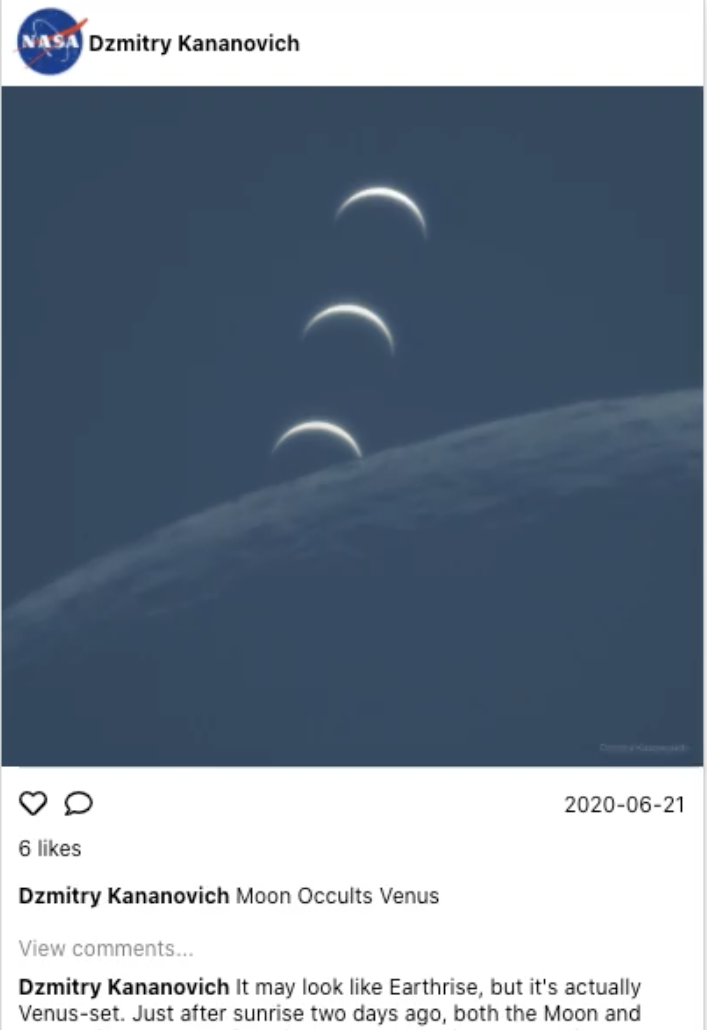

Good old days learning from Tim. He wore a Bitcoin tie every day - a true believer.